Jennifer Hughes in New York January 31, 2025

On Sunday night in Chicago, Steve Quirk by habit checked the S&P 500 futures prices and noted a large fall. The following day, the markets veteran was looking at figures showing a surge in overnight trading on online broker Robinhood as investor darling Nvidia slumped amid worries about Chinese AI upstart DeepSeek.

Nvidia’s travails produced the second-biggest late-night trading session for Robinhood, best known for popularising smartphone-based trading. It has offered overnight dealing for the past 18 months and Monday ranked for volume behind only the night of the US presidential election in November.

“Our users don’t trade overnight once and go away,” says Quirk, Robinhood’s chief brokerage officer. “They look for an opportunity to do so again.”

Robinhood’s activity boom in the small hours is only the latest example of the growing interest in overnight trading — a trend fuelled by the availability of sophisticated trading apps on phones, and an increasingly knowledgeable base of small retail investors as comfortable trading Amazon from their sofas as they are shopping on it.

Many of these night owls developed a taste for trading during pandemic lockdowns, and a return to the office has pushed their investing habits outside of business hours. The overnight session — 8pm to 4am in New York — often sees them trading with Asia’s famously active household investors, who relish the chance to trade big US names in their daytime.

Although retail trading is big business in the US, where more than half of all households hold stocks directly, developments in mom-and-pop trading habits would normally mean little to the vastly bigger professional world of asset managers and Wall Street brokers.

But that is changing because of the growing interest in overnight trading from more established quarters. The New York Stock Exchange, the largest in the world, is one of a number of groups which are now looking to offer much longer trading windows.

This is pushing investment professionals to engage in surprisingly complex debates around the simplest-seeming questions.

When, for example, does a trading day begin and end if it runs around the clock? What would be the closing price of a stock — typically the reference point for trillions of dollars in funds — if the day were seamless?

Those are just a couple of the big questions about trading through the wee hours. Other worries include how portfolio managers deal with the risks of big moves in their holdings while they’re asleep, and the cost and difficulty of maintaining complex systems with little or no downtime.

“Talk 24-hour and the joke is, ‘I don’t know when our operations guy is going to sleep.’ That is an actual issue,” says Tyler Gellasch, chief executive of investor advocate Healthy Markets Association. “But I feel like that’s going to be the least of your worries when you wake up to a margin call on a big position.”

By some measures, stocks are already late to the overnight party.

The dollar trades 24 hours a day on various platforms around the world and dealing in S&P 500 index futures, which signal the likely market direction ahead of the New York opening, is brisk from the Tokyo morning onwards. Cryptocurrency investors, meanwhile, have never known anything but a 24-7 digital world.

From the earliest days of informal trading in lower Manhattan coffee houses, US stock markets have largely stuck to some form of a traditional business day, though precise hours have varied.

Even the rising power of west coast investors and companies has not altered the official New York 4pm close of business. The last major changes to the US Day were made some two decades ago, when exchanges began offering pre- and after-market sessions that now run from 4am Eastern to the open, and from the close to 8pm Eastern, respectively.

Traders in Los Angeles and San Francisco, three hours behind New York, suck up 5am starts for the joy of beating the traffic as they head home soon after 1pm on days when there is little to generate activity after 4pm in New York.

Daytime trading for stocks is also practical because it involves so many parties: a million-plus people are employed directly in the US securities industry, and there are the executives of the companies whose shares are being traded and the regulators who oversee it all.

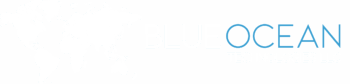

Adding to the complexity is the sheer scale of the $50tn market. Some 12bn shares are traded daily through millions of transactions. The counterparties include giant pension funds, high-speed traders dealing in milliseconds and individual investors trading a handful of shares. Every transaction must be agreed, with money and shares changing hands the next day. On top of all this is a web of intricate rules designed to ensure fair dealing.

Between 8pm and 4am in New York, overnight trading, including on Robinhood, is now mostly conducted through Blue Ocean, a so-called alternative trading system that launched in 2021 specifically to offer overnight access. Members of these alternative systems — also known as “dark pools” — trade among themselves at prices that are not made public.

While Blue Ocean’s volumes, about 40mn shares a night, are a tiny fraction of what the likes of the NYSE do on any regular day, it has steadily built a market linking American night owls with Asian day traders. Now two exchanges are eyeing its turf.

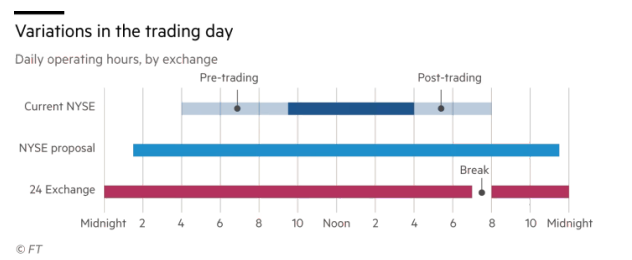

In November, the Securities and Exchange Commission tentatively approved 24 Exchange, or 24X, a Bermuda-based group backed by hedge fund billionaire Steve Cohen’s Point72 Ventures fund with plans to trade nearly all day long. Until recently, its main business had been currency trading. Once some key regulatory infrastructure is in place, it plans to open 23 hours a day with an hour for brokers to update their systems. Its approval makes it the first US exchange with an avowed goal of dealing overnight, although under industry pushback it shrank original plans that included weekend trading.

NYSE too, may soon join the sleepless fray. The SEC is yet to weigh in on its separate plan, put forward by the exchange a month earlier, that would see it extend its trading day from the current 4am-8pm to a much lengthier 1.30am-11.30pm.

The involvement of exchanges matters for the rest of the market because they are more tightly supervised than dark pools and are responsible for continuously publishing their best bid (buy) and offer (sell) prices through their trading day. These flow through a service known colloquially as the “tape”, against which any investor can compare the price they got from their broker, who has an obligation to execute trades at the best price.

“We’ve been hearing from multiple types of market participants for about two years now that they think there is demand and opportunity to extend hours further,” says Kevin Tyrrell, head of markets at NYSE.”

“We’ve also had global investors looking to the US more and more — for trading and investing and also large companies transferring their listings from other regions into the US. So it seems very natural for us to be having these conversations.”

Big industry reservations remain, however, from managing risk to having to operate all night.

“It’s not a solo game. Traders are always asking an analyst or a fund manager, ‘Hey, does this new price point mean something?’” says one senior dealer at a large global investor. “I think that’s the biggest fear for folks, is that they end up on call 24 hours.”

In June 2024, Justin Schack, a partner at Wall Street broker Rosenblatt Securities, appeared before a House committee looking into the US market set-up.

“It’s fair to say that no one with a blank slate would design such a complex system to achieve such a simple task,” Schack, who heads Rosenblatt’s market structure team, told the politicians when describing the current system.”

Other Wall Street brokers agree. Ask them about the issues that 24-hour advocates must address and they list thorny ones: clearing or guaranteeing trades, building out technology and staffing, running the “tape” to cover longer hours and ensuring all their systems can cope.

Traders have their concerns too, from how much stocks can move to whether regulators might factor overnight prices into how they apply daytime rules.

“What are the rules for overnight trading? If you did have a big price dislocation, where does the stock stop? Without clarity around specific items, I don’t think you’ll get institutional buy-in,” says Mehmet Kinak, global head of equity trading at T Rowe Price, in a reference to the so-called circuit breakers operating in daylight hours, which temporarily halt a stock that moves particularly sharply.

Kinak adds that thin liquidity during extended hours makes it an unattractive time for big players to trade US stocks. “What if a stock is indicated up 3 per cent and we happen to be a seller? By the time we are done executing an order for 200,000 shares, I’m not going to get a price anywhere near up 3 per cent, there’s just no depth or broad market participation.”

To guard against wild swings that can catch investors out, overnight trades currently operate under a limit order system, meaning investors cannot simply send buy or sell instructions, but must set the price at which they will trade. If no one takes that price, the order expires unfilled in the morning.

The global head of trading for a west coast asset manager agrees with Kinak that overnight offers limited trading opportunities for big investors, but cautions that not trading might not remove the dangers.

“The real questions, then, are about what we would have to consider in those hours for our oversight and technology,” he says. “Could a regulator come in and ask me about best execution, and point to prices overnight that I’m not capturing as part of my process? That could create an obligation to staff markets 24 hours. That’s a big burden to put on the entire industry.”

When the day starts and ends matters to investors everywhere too. Few in the industry want to change the official 4pm close — by far the busiest trading point in the current day because it is used to set the daily reference prices for traded securities, from which the $30tn-plus held in mutual and exchange traded funds take their value.

After the close, an entire system of clearing and settlement also kicks in, ensuring that sellers receive their payment and buyers have their new holdings re-registered under their name.

Additionally, it is when systems are adjusted for changes to shares, such as a company altering the number of shares trading or announcing a dividend payment date. These adjustments move share prices and brokers bear the cost if they miss one: in 2023 Robinhood took a $57mn hit when its systems failed to register a company that shrunk its share count.

24X plans a one-hour downtime at 7pm, while NYSE is suggesting two hours, not starting until 11.30pm. Those schedules raise some eyebrows.

“How are brokers going to test their systems? In the wee hours? We’d potentially be making thousands of market participants adjust to being able to work in the middle of the night and also work very quickly,” says Healthy Markets’ Gellasch.

Most of the questions industry insiders are asking do not yet have definitive answers.

They can seem outsized too, given that more than 80 per cent of trading today, despite the pre- and post-market sessions, is still done within the regular New York market hours of 9.30am to 4pm — and no one expects an imminent, sustained boom in back-of-the-clock dealing.

But the discussions keep growing. The merits, or otherwise, of 24-hour trading often produce the liveliest debates at industry conferences around the US. They veer between a sense of inevitability and questioning the need for an overnight session at all. Privately, many traders are worried about the knock-on effect on their personal lives if trading hours get longer.

Those already trading overnight are busy building ties with Asian brokers. Blue Ocean is opening a second Asia office in South Korea less than a year after its first in Tokyo. And on a trip this month to the region, 24X executives said they were overwhelmed with meeting requests.

“Asian retail investors have a very aggressive investing style and they want to trade Microsoft, Nvidia and Tesla in their daytime and we’re going to be well positioned to capture that,” says Dmitri Galinov, chief executive of 24X. “As volumes rise, institutions will come in.”

Meanwhile, more big US names are being drawn to trading out of hours. In November, Charles Schwab, the largest US broker, boasting $10tn in client assets, began offering overnight trading in more than 500 stocks and ETFs to its most active trader clients, up from 24 ETFs previously.

“Overnight trading has developed to the point we felt we could expand our offer,” says James Kostulias, head of trading services at Charles Schwab. “It’s not a new discussion by any means but it is now a reality.”